News

AUCTUS ranked second among “top financial investors” in the Oaklins Germany M&A Market Report H1 2021

Oaklins Germany, 05.08.2021: The M&A-industry has come back to full force after the first Corona-year in 2020. In the first half of 2021, we saw 1,476 announced or completed transactions in which a German company was involved as buyer, seller, or target. This represents an increase of 63% compared to the same period of the previous year, when Germany experienced its first lockdown. This increase is also striking in comparison to the first half of 2019 (+19%), when the world still seemed to be in order. Meanwhile, entrepreneurs, corporations, and financial investors have become accustomed to a world with Corona. Rising vaccination rates – at least in the Western world – have increased general confidence, and huge fiscal policy measures in the US, Europe, and China have ensured that the global economy has rebounded faster than originally expected.

Record activity by financial investors

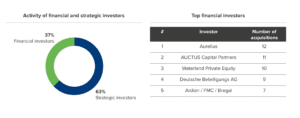

The relative involvement of financial investors in M&A-transactions with German participation in the first half of 2021 reached a record level of 37%. Just a few years ago, the share was below 20%. The Aurelius Group was the financial investor with the highest deal flow in the first half of 2021 with 12 transactions closed. AUCTUS Capital Partners ranked second with a total of 11 transactions completed, followed by Waterland Private Equity (10 deals), Deutsche Beteiligungs AG (9 deals) and Ardian, FMC and Bregal, which were the fifth most active financial investors with 7 deals each. On average, about 35% of the deals executed by the financial investors were new platform-acquisitions, while 65% of the deals were add-on-acquisitions for existing platform-investments. This enormous growth can be explained by the high level of funds made available by investors. Funds in the billion’s euro range are no longer a rarity in Germany. The only sector in which financial investors closed more transactions than strategic investors in absolute figures was the area of financial services.

Read the full report here: Oaklins M&A Market Report H1 2021

About AUCTUS

AUCTUS is the most active investment company for small- and medium-sized companies. With more than 250 investments in the last 20 years, we are the definite No. 1 in Germany. Our successful work is regularly rewarded with prestigious awards and top international rankings.

The focus of our investments is on majority holdings in companies with annual sales of between EUR 10 million and EUR 150 million.

AUCTUS stands for sustainable organic and also inorganic growth by acquisitions. We achieve this in a trustful partnership together with the management of our companies. We are specialized in building successful medium-sized company groups – We create market leaders.

The 23 experienced AUCTUS investment experts currently manage 38 platform investments from various sectors of the economy. The sum of the platform investments with a total of more than 150 individual companies achieves annual sales of more than € 1 billion. Sales and results have been growing at >10% per year for years.